Details

5 Common Mistakes Hosts Make with Airbnb Damage Claims (and How to Avoid Them)

Even with Airbnb’s AirCover damage protection, not every host’s claim goes smoothly. Many hosts walk away frustrated — denied, underpaid, or stuck in endless back-and-forth with support. The hard truth: Airbnb doesn’t operate as your partner here. Much like an insurance company, their claims system is designed to save them money, not maximize your reimbursement.

If you want to protect your short-term rental business, you need to approach AirCover claims like a negotiation — firm, evidence-backed, and strategic. Below are five common mistakes that derail hosts’ claims (and what to do instead), plus a pro tip at the end that could save you thousands.

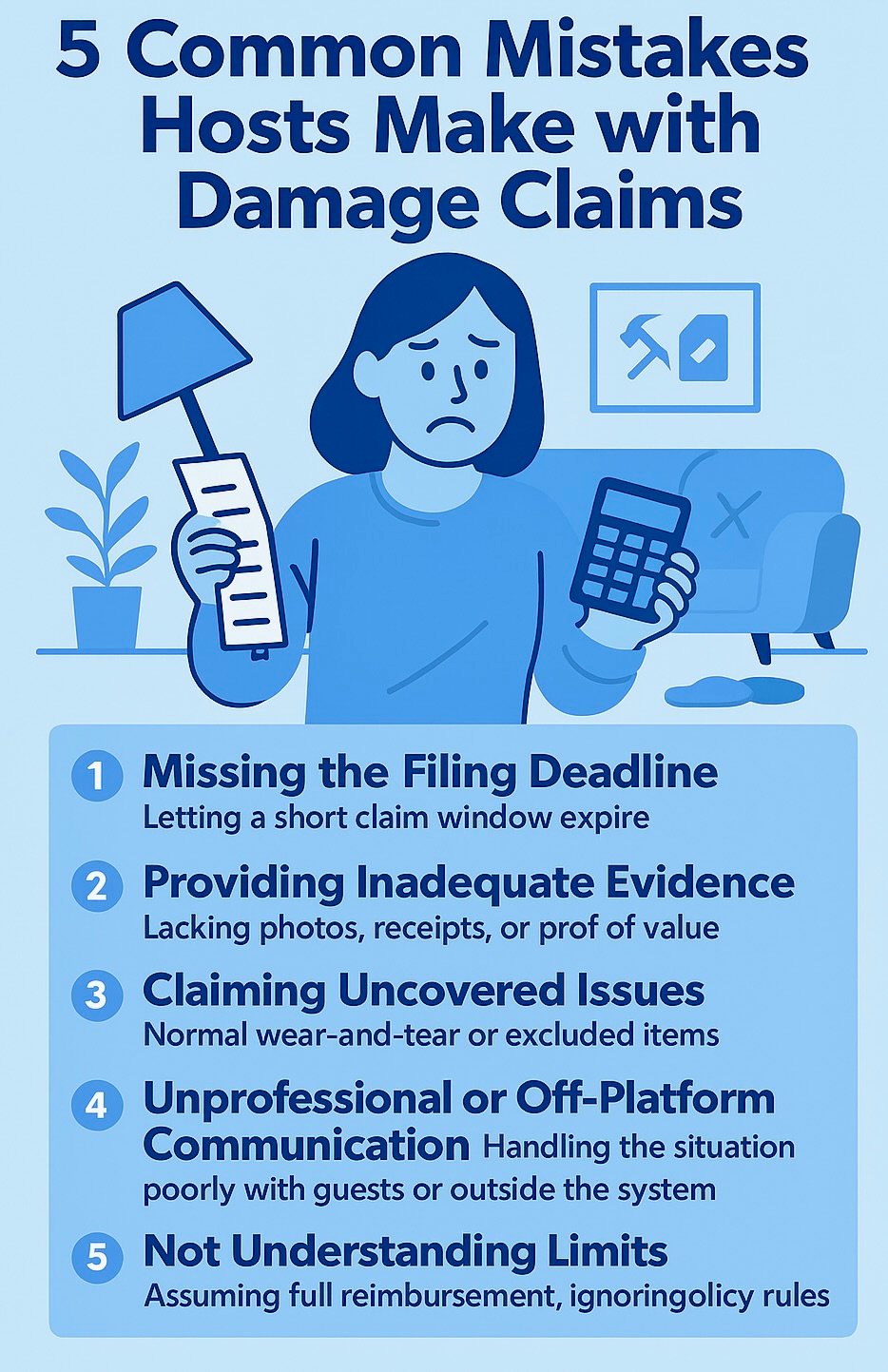

Mistake 1: Missing the Deadline to File a Claim

Airbnb requires that hosts file a damage claim within 14 days of the guest’s checkout, or before the next guest checks in — whichever comes first. Miss that window, and Airbnb will almost always deny your claim outright.

Many hosts lose out simply because they didn’t inspect their property quickly enough or waited too long to pull together receipts.

How to avoid it:

Inspect the property immediately after checkout (have your cleaner or co-host do this if you can’t).

Set a routine: Checkout at 11 AM, inspection by 3 PM, claim filed by 6 PM if needed.

File a preliminary claim right away — you can add more documents later.

👉 Remember: Airbnb timestamps every submission. Filing late is game over, no matter how legitimate the damage is.

Mistake 2: Weak Evidence and Documentation

Airbnb doesn’t take your word for it. “The guest ruined my $500 coffee table” won’t cut it. Without strong proof, Airbnb will side with the guest every time.

How to avoid it: Build a complete evidence packet.

Photos: Multiple angles, well-lit, timestamped. Include before photos from your listing to show the item was intact.

Receipts: Provide the purchase receipt, or at minimum a comparable product listing. Credit card statements work too.

Repair Estimates: If something needs fixing, get a quote on official letterhead.

Guest Messages: If the guest admits fault in writing, that’s gold.

For Theft: Provide proof it existed (photos, inventory list) and file a police report for high-value items.

The more airtight your packet, the harder it is for Airbnb to deny or lowball you.

Mistake 3: Filing for the Wrong Things

AirCover does not cover everything. Many hosts waste time (and credibility) filing for things Airbnb will never pay out: routine wear, aging appliances, or maintenance issues.

But here’s the flip side: don’t ignore small damages. A broken plate, a missing towel, or a deep-cleaning bill after a guest smoked inside — those are legitimate claims. If you don’t file, you’re just leaving money on the table. Small claims add up over a year, and you’re paying for those replacements out of pocket otherwise.

How to avoid it:

Don’t claim: normal wear-and-tear, cosmetic dings, pre-existing issues, or damage unrelated to the guest.

Do claim: every legitimate guest-caused damage — from broken wine glasses to $5,000 TVs.

Airbnb will always try to pay less. That means you should not “be reasonable” and undervalue an item up front. List the full price you paid (or slightly higher with proof). Let them negotiate you down — don’t lowball yourself.

Mistake 4: Poor or Off-Platform Communication

Airbnb requires that you contact the guest first through the Resolution Center. Skip that, and they’ll bounce your claim back. But many hosts hurt themselves further by handling communication poorly — arguing with the guest, going off-platform, or making threats.

How to avoid it:

Stay professional: Keep everything polite and fact-based. Assume Airbnb support will read every word.

Stay on-platform: Use Airbnb messaging only. No texts, no phone calls.

State facts, not feelings: “Here are photos of the broken lamp and the $150 receipt” works better than “You trashed my house and you’d better pay.”

Don’t escalate: If the guest refuses or ignores you after 24 hours, escalate to Airbnb and let them handle it.

Airbnb’s reps look closely at tone. If you come across calm and reasonable, and the guest looks uncooperative, you’ve already tilted the odds in your favor.

Mistake 5: Not Knowing AirCover’s Limits

The biggest frustration hosts face is expecting AirCover to be “full coverage.” It’s not. It has limits, exclusions, and loopholes that can slash your payout.

Here’s what trips up most hosts:

Depreciation: Airbnb often pays you the depreciated value, not replacement cost. That five-year-old $1,000 sofa might get valued at $500. This is why you must claim at the full price you paid or slightly more. If you ask for less, they’ll cut it even further.

Guest-first policy: You have to give the guest 24 hours to pay before AirCover kicks in. Skip this step, and your claim may be tossed.

Exclusions: No coverage for emotional distress, utility bills, cash, personal valuables, or future potential income beyond canceled bookings. Theft claims usually require a police report.

Payout mindset: Airbnb reps are incentivized to keep costs down. They will find reasons to trim or deny unless your claim is bulletproof.

How to avoid it:

Know the rules cold. File claims within 14 days, contact the guest first, document everything.

Always push for the full value of the item (with proof). Don’t volunteer depreciation.

If they lowball you, politely push back with documentation. Many hosts win better payouts on appeal.

Bonus Mistake: Going It Alone on Big Claims

Filing a claim for a broken lamp is straightforward. Filing for $7,000 in damages from a wild party is not. Big claims involve endless back-and-forth, multiple estimates, and lots of pushback from Airbnb. Many hosts give up or settle for far less.

How to avoid it: Get help.

Tap the community: Forums, Facebook groups, Reddit — hosts share real-world experiences that can save you from rookie mistakes.

Use a claims service: Companies like ClaimPilotPlus exist to handle this fight for you. For a fee or percentage, they’ll manage the paperwork, evidence, and negotiations to make sure Airbnb doesn’t lowball you. If they turn a denied claim into a $5,000 payout, the service pays for itself many times over.

If hosting is your business, think of ClaimPilotPlus like having an attorney in your corner. Airbnb has policies, reps, and insurers protecting their bottom line. You deserve someone protecting yours.

Final Takeaway

To win Airbnb damage claims, you need to treat the process like a business negotiation, not a customer service request. That means:

File fast (within 14 days).

Document everything with photos, receipts, and messages.

Claim all legitimate damages — big and small.

Communicate professionally on-platform.

Know the limits and push back when Airbnb tries to undervalue your losses.

And if the claim is big or you’re overwhelmed? Don’t go it alone. Services like ClaimPilotPlus exist to make sure hosts don’t get the short end of the stick.

Hosting is your business. Protect it like one.

📌 Sources: Airbnb Help Center – Host Damage Protection policies; Airbnb Community Center; host case studies from forums (airhostsforum.com, masterhost.ca); industry blogs on AirCover limitations (completehospitalitymanagement.com, thanksforvisiting.com).